Predicting Effective Tax Rate of Publicly-Traded Firms

Description

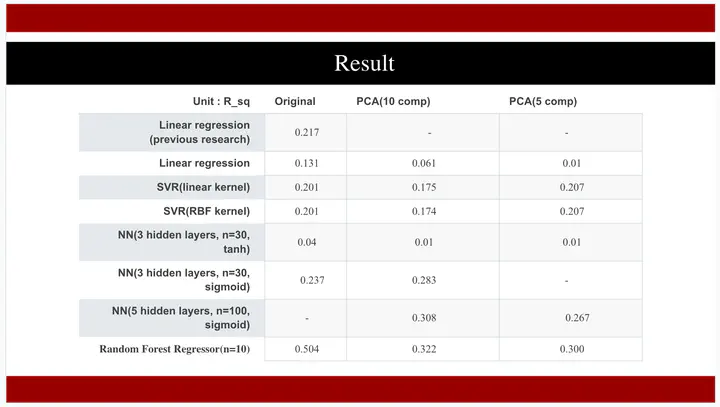

The purpose of this project is to analyze business firms’ text disclosures to determine if those text disclosures are related to firms’ tax rates. In so doing we first capture information about the text and then relate that text information to quantitative information, using statistical modeling. So far, we have generated and used some bags of words to capture information that we expect will provide insight into the tax rates that those firms incur. Our knowledge acquisition approach, to gather those bags of words, was to interview an expert. We then counted the number of occurrences of those words in our text, and used statistical models to relate the number of those occurrences to different measures of tax rates. We find that those bags of words are statistically significantly related to measures of tax rates that firms pay. In addition, we find that “tax specific bags of words” work “better” than “generic accounting bags of words.”

Awards

- Highlighted Project

Students

Advisors

Skills Required by the team

- Statistical Analysis

- Text Analysis